Custom Private Equity Asset Managers Can Be Fun For Everyone

Wiki Article

Custom Private Equity Asset Managers - An Overview

(PE): spending in firms that are not publicly traded. Approximately $11 (https://yoomark.com/content/custom-private-equity-management-group-completes-indepth-research-market-needs-we-create). There may be a couple of points you don't comprehend concerning the sector.

Private equity firms have a range of financial investment choices.

Because the most effective gravitate toward the bigger bargains, the center market is a considerably underserved market. There are more sellers than there are extremely experienced and well-positioned money specialists with considerable purchaser networks and resources to manage an offer. The returns of private equity are commonly seen after a couple of years.

The Custom Private Equity Asset Managers Ideas

Flying below the radar of large international corporations, a number of these little firms commonly provide higher-quality customer support and/or specific niche products and solutions that are not being used by the big corporations (https://cpequityamtx.weebly.com/). Such benefits bring in the rate of interest of exclusive equity companies, as they have the insights and savvy to exploit such possibilities and take the company to the following level

Private equity capitalists need to have dependable, capable, and reputable monitoring in location. Many supervisors at profile firms are offered equity and reward payment frameworks that reward them for striking their monetary targets. Such alignment of objectives is normally required prior to a deal obtains done. Personal equity opportunities are usually unreachable for people that can't spend countless bucks, however they shouldn't be.

There are laws, such as restrictions on the accumulation quantity of money and on the variety of non-accredited investors. The exclusive equity company attracts a few of the ideal and brightest in corporate America, including leading entertainers from Fortune 500 firms and elite administration consulting firms. Law office can additionally be recruiting grounds for personal equity works with, as bookkeeping and lawful abilities are required to full offers, and transactions are click to read very searched for. https://www.cheaperseeker.com/u/cpequityamtx.

The 7-Minute Rule for Custom Private Equity Asset Managers

One more drawback is the absence of liquidity; as soon as in an exclusive equity transaction, it is not simple to get out of or offer. With funds under monitoring currently in the trillions, exclusive equity companies have become eye-catching investment automobiles for affluent individuals and institutions.

For years, the qualities of private equity have actually made the possession class an appealing recommendation for those that could get involved. Since accessibility to private equity is opening as much as even more individual financiers, the untapped possibility is coming true. The question to take into consideration is: why should you invest? We'll start with the main debates for buying personal equity: Just how and why exclusive equity returns have traditionally been greater than various other properties on a variety of degrees, Just how consisting of exclusive equity in a profile impacts the risk-return profile, by assisting to diversify against market and intermittent danger, After that, we will detail some key considerations and dangers for private equity financiers.

When it concerns introducing a new property right into a profile, one of the most basic factor to consider is the risk-return account of that asset. Historically, private equity has displayed returns comparable to that of Arising Market Equities and greater than all various other traditional property courses. Its fairly reduced volatility combined with its high returns produces a compelling risk-return profile.

Not known Details About Custom Private Equity Asset Managers

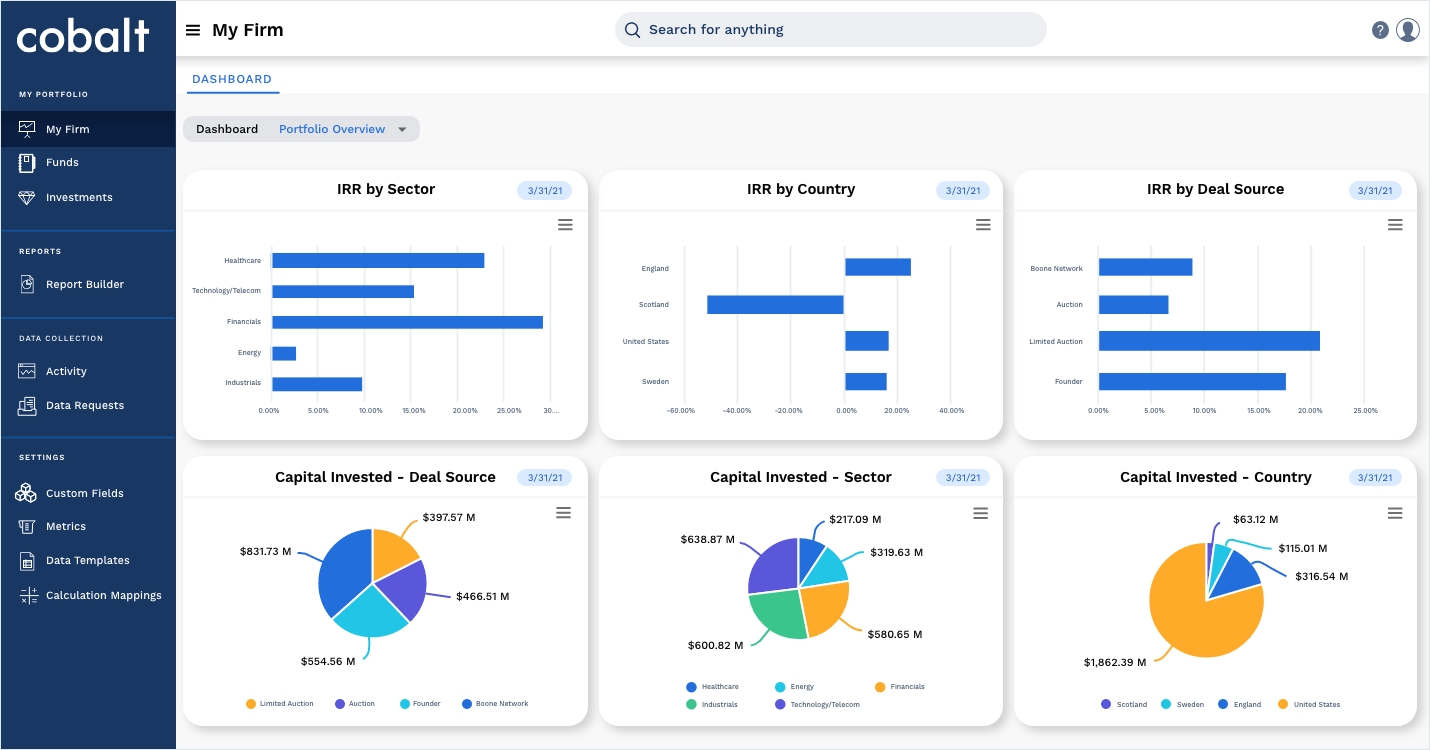

As a matter of fact, exclusive equity fund quartiles have the largest series of returns throughout all different asset courses - as you can see listed below. Method: Inner rate of return (IRR) spreads out calculated for funds within classic years independently and then averaged out. Typical IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The impact of adding private equity right into a portfolio is - as always - reliant on the profile itself. A Pantheon research from 2015 suggested that consisting of exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the ideal private equity companies have accessibility to an also bigger swimming pool of unknown possibilities that do not deal with the very same scrutiny, along with the sources to carry out due diligence on them and identify which deserve spending in (Asset Management Group in Texas). Investing at the ground floor indicates greater threat, but for the companies that do be successful, the fund take advantage of greater returns

Facts About Custom Private Equity Asset Managers Uncovered

Both public and exclusive equity fund supervisors devote to investing a portion of the fund but there continues to be a well-trodden concern with straightening passions for public equity fund administration: the 'principal-agent issue'. When an investor (the 'principal') hires a public fund supervisor to take control of their capital (as an 'agent') they delegate control to the manager while keeping ownership of the possessions.

In the case of exclusive equity, the General Companion does not simply gain a monitoring cost. Private equity funds likewise alleviate another form of principal-agent trouble.

A public equity financier ultimately desires one point - for the administration to increase the supply rate and/or pay rewards. The capitalist has little to no control over the decision. We revealed above the amount of personal equity techniques - specifically majority buyouts - take control of the operating of the business, guaranteeing that the lasting worth of the company comes initially, rising the return on financial investment over the life of the fund.

Report this wiki page